How Should Singaporeans Invest in Property in 2023 and Beyond?

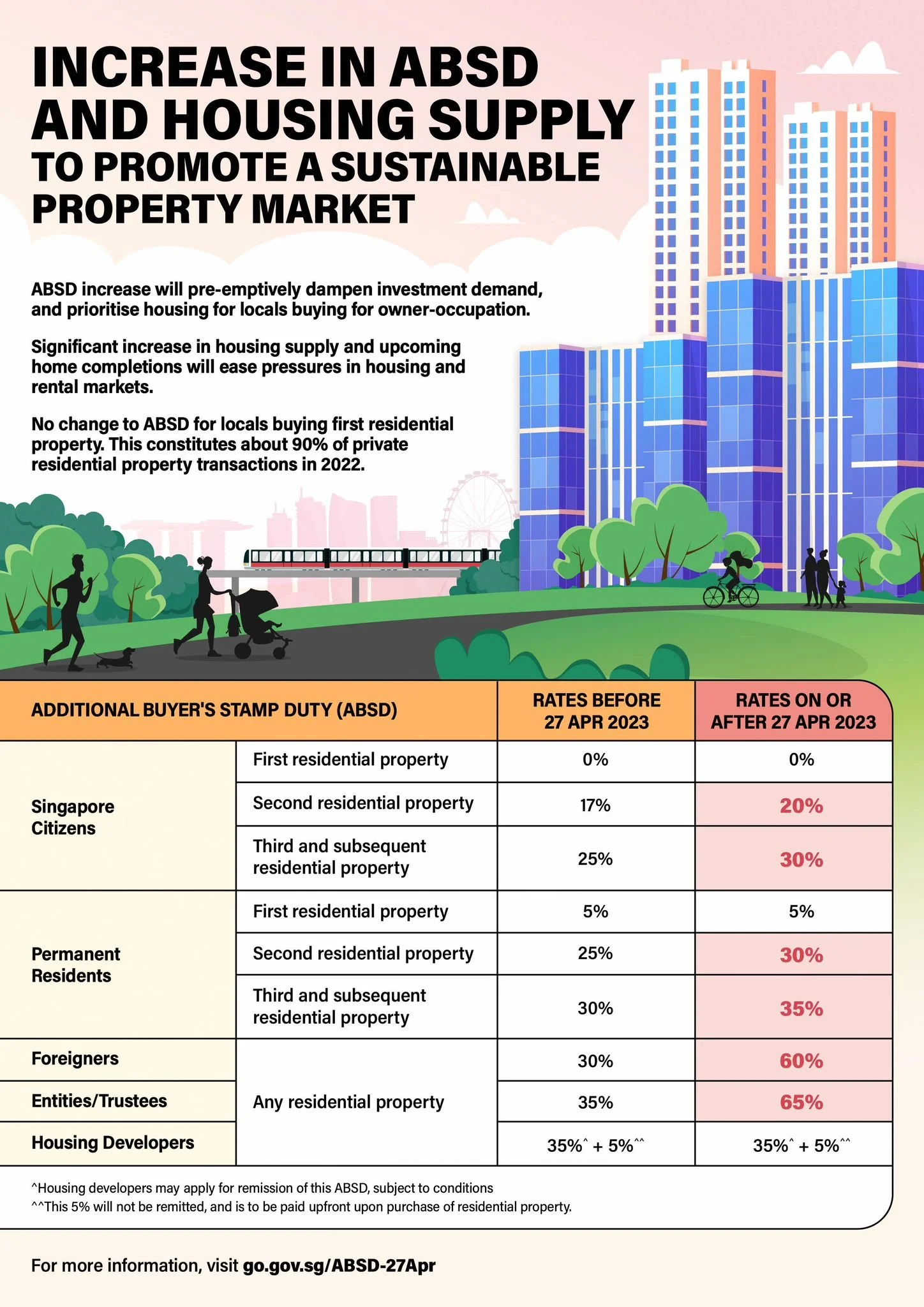

More cooling measures to ensure available housing supply is prioritised for homeowners instead of investors.

With ABSD now at 20-30%, the Singaporean dream of buying an investment property to rent out is getting further out of reach.

For a $1.4m purchase price, 20% would be $280k!

Here are a few key points we as investors need to note:

🏠 simple economics, cooling measures dampen demand. Government ramps up the supply of both HDB and the supply of land for private developers. Cumulative effect? Softening price increases. Don’t confuse this with softening prices.

🏠 cooling measures are targeted at investors, foreigners and companies/trusts. Anyone who wants to buy property but not for their own stay.

🏠 like in previous years, there will be more interest in overseas property investments, most of which will be new builds, in countries such as BKK, Cambodia, Australia, New Zealand UK and even more novel destinations like Japan, and the USA.

Which country is best? Which project will make money?

❤️ Capital appreciation is challenging in the coming years, with cooling measures, recessionary headwinds, and rising unemployment. What we’ve enjoyed in the last 3 years fuelled by inflation will not be the case in the next 3-5 years.

❤️ I’m not saying property prices globally will crash, but grow slower, and plateau.

❤️ What does this mean for property investors? Invest only in golden goose properties that can generate positive cashflow and passive income (in spite of high-interest rates)

For our community of Golden Goose Property investors buying existing properties in the UK, adding value to them through refurbishment and renting them out for a monthly profit, it’s business as usual.

Follow me to stay in tune with the latest thought leadership in #propertyinvestment #goldengooseproperty #ukproperty